Bạn đang đọc: Days Payable Outstanding | Examples with Advantage & Disadvantage

Introduction to Days Payable Outstanding

Days payable outstanding (DPO) is a measure of the average time that an entity takes to pay its suppliers or creditors. Usually, greater duration means the funds are kept with the company for long, and it is slow to pay back its liabilities. However, depending on the industry to which the firm belongs and the customs followed in terms of payment, the DPO may vary into seemingly unfavorable numbers. Also, in case a company has greater DPO, it becomes more flexible to utilize the funds available for its working capital and investment purposes.

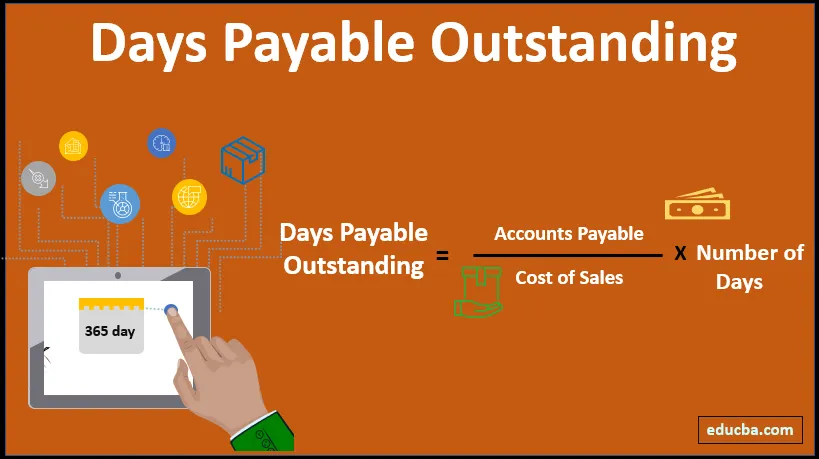

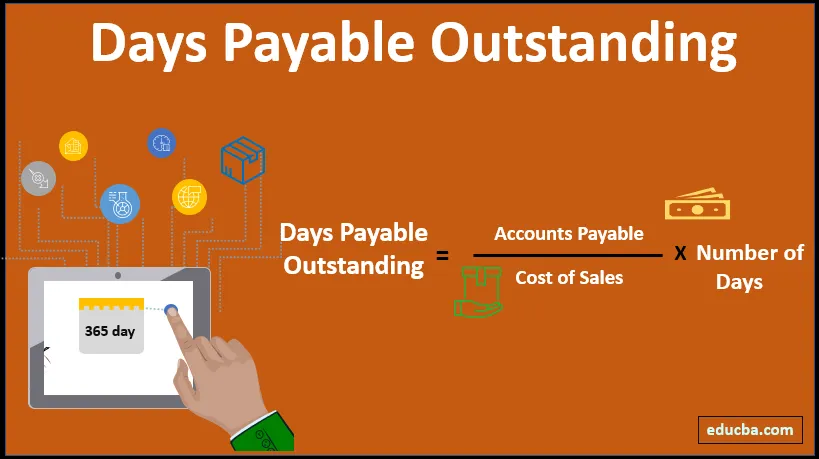

Formula:

Before the formula is listed, the following terms need to be described:

Accounts Payable – the short term liabilities that are accrued and that needs to be paid back to carry on with the daily operations

Cost of Sales – It is the sum total of all the expenses that are incurred to get the product in a position that it can be sold to the customers. Usually, it includes the cost of raw material, direct costs on transportation and rent that can be allocated to the product

A Number of Days – It refers to the period over which the DPO is calculated. It could be either weekly, monthly or an annual basis.

Examples of Days Payable Outstanding (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

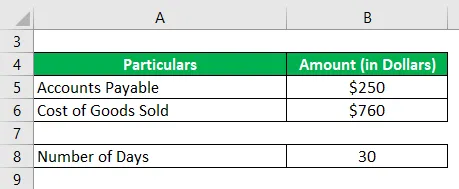

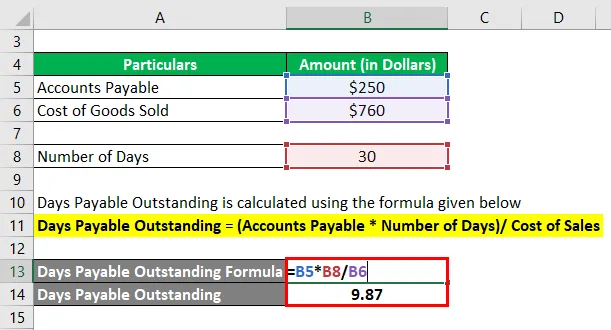

Example #1

Organization X has an outstanding payable of $2500, and the cost of sales in producing the product is $760; the entity wants to calculate the days payable outstanding on a monthly basis.

This is a straightforward problem where the total of outstanding payable is given, and the cost of sales is mentioned to compare against. The only thing to consider here is that the calculation has to be made monthly rather than the frequent annual cycle.

Solution:

DPO is calculated using the formula given below

Days Payable Outstanding = (Accounts Payable * Number of Days)/ Cost of Sales

- Days Payable Outstanding = ($250 * 30) / $760

- Days Payable Outstanding = 9.87

Example #2

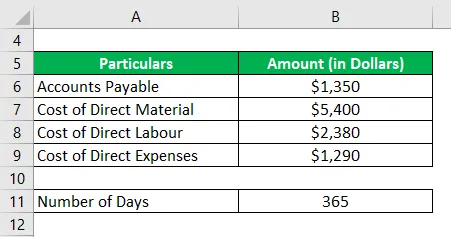

Organization Y has an account payable at the yearend of $1,350. The direct costs that have been incurred are as follows:

Calculate the days payable outstanding on an annual basis

Solution:

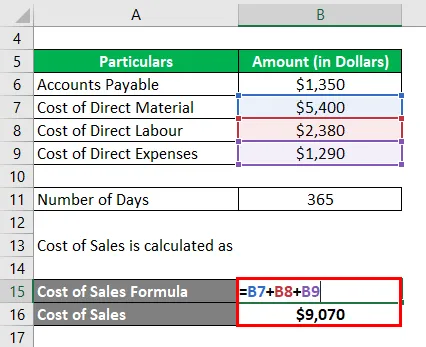

The accounts payable is mentioned as a single slab here, whereas the cost of sales is divided into various categories. This is because the cost of sales involves the sum of the material, labour, and other direct expenses that went into getting the final product. Also, this problem takes us back to the annual cycle of 365 days.

Cost of Sales is calculated as

Tìm hiểu thêm: Other ways to say "I LOVE YOU"

- Cost of Sales = $5,400 + $2,380 + $1,290

- Cost of Sales = $9,070

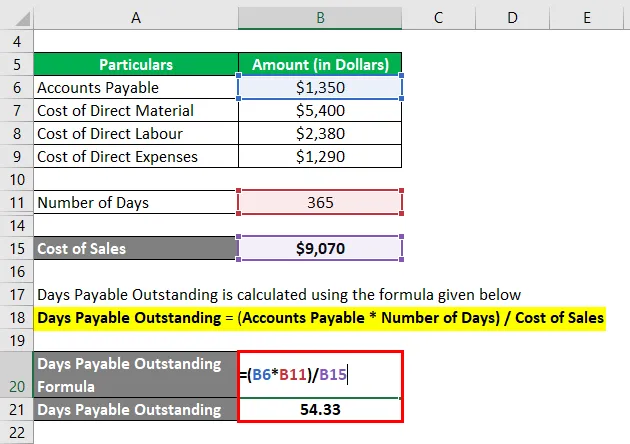

DPO is calculated using the formula given below

Days Payable Outstanding = (Accounts Payable * Number of Days)/ Cost of Sales

- Days Payable Outstanding = ($1,350 * 365) / $9,070

- Days Payable Outstanding = 54.33

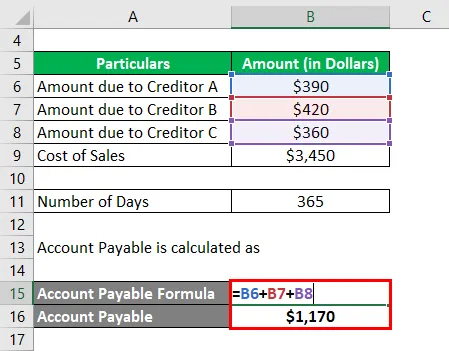

Example #3

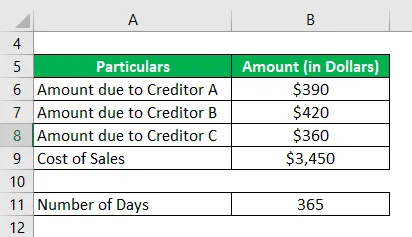

Organization Z has the following list of creditors

The cost of sales during the entire year is $3450. Calculate the days payable outstanding for the year.

Solution:

The account payable might not be a single payment due to a creditor; rather, it could be sum of dues to different sources. Therefore, for the evaluation of DPO, calculate the sum of all such expenses as the requirement is to ensure all the external liabilities within the scope of payables are covered.

Account Payable is calculated as

- Account Payable = $390 + $420 + $360

- Account Payable = $1,170

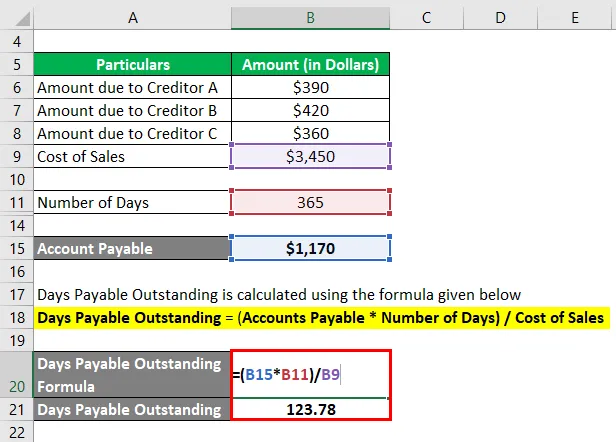

DPO is calculated using the formula given below

Days Payable Outstanding = (Accounts Payable * Number of Days)/ Cost of Sales

>>>>>Xem thêm: 8 cây cọ trang điểm cần thiết nhất

- Days Payable Outstanding = ($1,170 * 365 ) / $3,450

- Days Payable Outstanding = 123.78

Advantages and Disadvantages DPO

The advantages and disadvantages are as follows :

Advantages

- DPO enables the business to ensure timeliness in terms of payment from the debtors and payments to be made to the creditors. The schedule could be planned to ensure the optimum utilization of the funds in hand.

- The entity could compare the terms of the various debtors and creditors, also involving applications from the newer ones to see if they fall within the ambit of their future plan.

- The entity could compare their own DPO with the industry standards and check if they are ahead, on track or falling behind the general trend, and would this require some corrective action on their part.

Disadvantages

- DPO is not an accurate measurement of the efficiency of using funds. There could be industry, season, or market-specific issues that are not helping the duration to be at the optimum level. If that is the case, there is no need to panic and accounting to take this into account.

- Although DPO enables the management to better utilize the funds, generally, there is not much the entity could do in terms of checking the DPO since the terms of the creditors and debtors are generally fixed and not amenable to much change.

Important Points to Note

- DPO is a turnover ratio that helps to assess the day’s duration between the payables and receivables and gives a generic view of the liquidity. However, it is in no way the end decision-making process for the management.

- The calculation varies in terms of the days that are marked for the period; there could be yearly, monthly or weekly assessments.

- The cost of sales is generally restricted to the direct material, labour, and other expenses incurred in getting a product to the final place. However, if there are certain exceptional costs that become a part, they should be included and pointed out separately.

Conclusion

DPO is used extensively by entities in the trading business. It is insightful to the trade cycle and the general trend in the market. The control over the deviation of this ratio is used for variation analysis period over period, and analysis is made on this basis.

Recommended Articles

This is a guide to the Days Payable Outstanding. Here we discuss how it can be calculated using a formula and the Advantages and Disadvantages of Days Payable Outstanding and a downloadable excel template. You can also go through our other suggested articles to learn more –

- Days Sales Outstanding

- Days Inventory Outstanding

- Days in Inventory

- Days Sales Uncollected